Whereas the price of residing has risen considerably throughout Canada, some main municipalities are extra inexpensive than others–however none are inexpensive for single-income residents who make minimal wage.

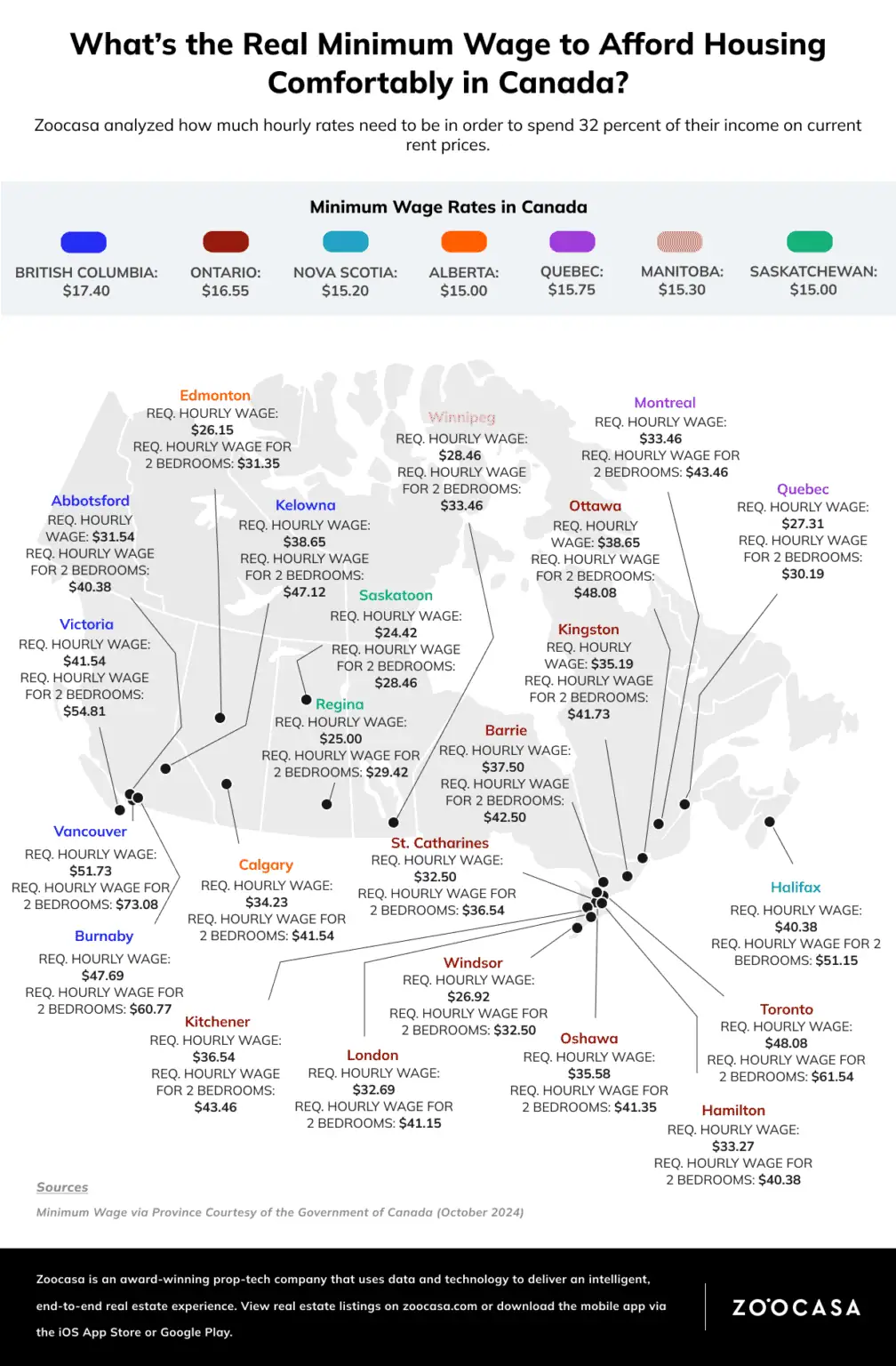

A latest report by actual property brokerage and web site Zoocasa broke down how a lot residents throughout Canada must make to comfortably afford one- and two-bedroom residences of their cities and cities.

Utilizing the Canadian Mortgage and Housing Company’s suggestion that not more than 32 per cent of an individual’s revenue go in direction of shelter prices, the report discovered that securing an inexpensive rental is an not possible feat for a lot of earners and that many are paying considerably greater than the advisable quantity.

“Rent prices have soared well beyond this threshold in numerous cities nationwide, putting immense financial strain on millions,” the report reads.

Based on the report, the typical lease for a one-bedroom condo in St. Catharines is $1,690–a lot decrease than the Toronto common of $2,500. That mentioned, to comfortably afford an condo, a tenant must earn not less than $32.50 an hour or $63,375 a yr.

In Ontario, the minimal wage presently sits at $17.20 an hour–far under what’s wanted to comfortably afford a smaller unit.

Concerning two-bedroom models, a St. Catharines resident would want to earn $36.54 an hour ($71,250 a yr) to comfortably afford a unit priced at $1,900 a month.

The report suggests renting is less complicated for {couples}. If two individuals earn minimal wage in St. Catharines, they will comfortably afford to spend $1,721 on lease–greater than is required for a one-bedroom unit. That mentioned, a two-bedroom could be more durable, leaving them spending $179 greater than is advisable.

The report says that whereas the disparity isn’t stunning in main cities resembling Toronto and Vancouver, the fact is stark throughout the nation.

In Edmonton, the place the minimal wage is $15 per hour, a full-time employee ought to spend not more than $780 month-to-month on lease–an impossibility with a one-bedroom unit averaging about $1,360 a month. Calgary, a extra inexpensive large metropolis than its counterparts in B.C. and Ontario, can be more durable for tenants. The report says that following the 32 per cent rule would imply a employee making minimal wage wouldn’t manage to pay for to afford a $ 1,780-a-month condo.

In the end, the report says that minimal wage shouldn’t be sufficient for many Canadians to lease a house that prices not more than 32 per cent of their revenue.

“Across Canada, the gap between minimum wage and rent costs is undeniable, as rent far exceeds what minimum-wage earners can reasonably afford. Even in more affordable markets, the gap between wages and rental costs remains significant, pushing many Canadians into housing insecurity or sacrificing other essential expenses just to keep a roof over their heads,” the report reads.

“To address this growing housing affordability crisis, policymakers must consider increasing the minimum wage to align with the cost of living, implementing stricter rent controls, or investing in more affordable housing options. Without such interventions, millions of Canadians will continue to face the complicated reality of being unable to afford safe and secure housing.”

inNiagaraRegion’s Editorial Requirements and Insurance policies